For gamblers, the tax code offers unfavorable odds. Win, and you owe tax at your ordinary income rate, now as high as 35%. Lose….and you lose. There is no tax benefit.

However, savvy gamblers can offset taxable winnings with their losses if they can document those losses. The better your recordkeeping, the less tax you’ll ultimately owe if you should happen to get lucky.

The 5-star Thermia Palace spa hotel is nestled within the wonderful ambiance of the Spa Island of Piestany, offering a historic atmosphere and up-to-date facilities like the Irma Health Spa. While restoring this Art Nouveau building to its former glory much of the interior was preserved, including the weighty crystal chandeliers, painted stucco. Casino piestany slovakia facts. The #1 Best Value of 66 places to stay in Piestany. Health Spa Resort Hotel Thermia Palace. #2 Best Value of 66 places to stay in Piestany. Spa Hotel Pro Patria. #3 Best Value of 66 places to stay in Piestany. See Tripadvisor's Piestany, Trnava Region hotel deals and special prices on 30+ hotels all in one spot. Find the perfect hotel within your budget with reviews from real travelers.

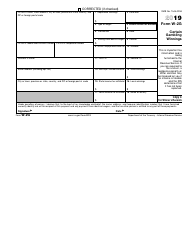

All gambling winnings are recorded on Line 21 ('Other Income') of your Form 1040 individual tax return. Can you deduct gambling losses? Yes, but ONLY if you itemize your deductions on Schedule A of your Form 1040. If you claim the standard deduction, you cannot deduct any gambling losses. Also, the amount of gambling losses you deduct. If, like the vast majority of people, you're a casual recreational gambler, you're supposed to report all your gambling winnings on your tax return every year. You report the amount as 'other income' on Schedule 1 of IRS Form 1040. You list them as 'other income' in line 21. Amount of your gambling winnings and losses. Any information provided to you on a Form W-2G. The tool is designed for taxpayers who were U.S. Citizens or resident aliens for the entire tax year for which they're inquiring.

House rules

Casual gamblers (that is, persons not in the trade or business of gambling) should report any gambling winnings on line 21 of Form 1040 under “other income.� Those winnings include money won at a casino or race track. Lotteries, bingo, raffles, etc., are all considered gambling, so you must report any success in those areas.

Example 1: Paul Sawyer wins $1 million in the lottery, payable over 20 years. In 2012, Paul sells the rights to his future payments for $400,000. On his 2012 tax return, Paul reports $400,000 of gambling winnings. (If Paul had chosen to receive $50,000 per year, he would report $50,000 on his 2012 tax return.) According to cases such as U.S. v. Maginnis, decided by the Court of Appeals for the Ninth Circuit in 2004, money received from such a sale is taxed as ordinary income, so sellers won’t get the favorable tax rate on long-term capital gains.

You’ll also owe tax if you win a prize instead of cash. Typically, the entity awarding the prize will put a fair market value on the car, trip, or other item and report that to the IRS on Form 1099. You’ll owe tax on the reported amount. If you think the value is overstated, you can report a lower amount, but you should be ready to support your claim to the IRS, if challenged. For example, make sure you can prove you sold the “$2,000 flat screen TV� you won to an unrelated third party for $1,200 immediately after you received it.

All gambling winnings are recorded on Line 21 ('Other Income') of your Form 1040 individual tax return. Can you deduct gambling losses? Yes, but ONLY if you itemize your deductions on Schedule A of your Form 1040. If you claim the standard deduction, you cannot deduct any gambling losses. Also, the amount of gambling losses you deduct. If, like the vast majority of people, you're a casual recreational gambler, you're supposed to report all your gambling winnings on your tax return every year. You report the amount as 'other income' on Schedule 1 of IRS Form 1040. You list them as 'other income' in line 21. Amount of your gambling winnings and losses. Any information provided to you on a Form W-2G. The tool is designed for taxpayers who were U.S. Citizens or resident aliens for the entire tax year for which they're inquiring.

House rules

Casual gamblers (that is, persons not in the trade or business of gambling) should report any gambling winnings on line 21 of Form 1040 under “other income.� Those winnings include money won at a casino or race track. Lotteries, bingo, raffles, etc., are all considered gambling, so you must report any success in those areas.

Example 1: Paul Sawyer wins $1 million in the lottery, payable over 20 years. In 2012, Paul sells the rights to his future payments for $400,000. On his 2012 tax return, Paul reports $400,000 of gambling winnings. (If Paul had chosen to receive $50,000 per year, he would report $50,000 on his 2012 tax return.) According to cases such as U.S. v. Maginnis, decided by the Court of Appeals for the Ninth Circuit in 2004, money received from such a sale is taxed as ordinary income, so sellers won’t get the favorable tax rate on long-term capital gains.

You’ll also owe tax if you win a prize instead of cash. Typically, the entity awarding the prize will put a fair market value on the car, trip, or other item and report that to the IRS on Form 1099. You’ll owe tax on the reported amount. If you think the value is overstated, you can report a lower amount, but you should be ready to support your claim to the IRS, if challenged. For example, make sure you can prove you sold the “$2,000 flat screen TV� you won to an unrelated third party for $1,200 immediately after you received it.

Poker tournaments casino rama buffet. Reporting and withholding

Tax payers are supposed to report gambling winnings, like all forms of income, in full. To help enforce compliance, the gaming establishment must report certain winnings to the IRS on Form W-2G. For example, winnings (not reduced by the wager) of $1,200 or more from a slot machine must be reported; the same is true for winnings (reduced by the wager or buy-in) of more than $5,000 from a poker tournament. In many cases, 25% will be withheld and sent to the IRS on winnings over $5,000.

Taxpayers who do not provide a Social Security number when requested may be subject to 28% backup withholding.

Tax Form For Gambling Winnings Irs

Regardless of whether anything was withheld, you must report all of your gross gambling winnings on line 21 of Form 1040. This is not where you net your gambling winnings and losses.

Listing your losses

In order to get any tax benefit from gambling losses, you must itemize deductions on Schedule A of Form 1040. If you take the standard deduction instead, you’ll owe tax on the full amount of your gambling winnings.

Where To List Gambling Winnings On 1040 Tax Form

On Schedule A, you can list all your gambling losses. In effect, this will trim the tax on your gambling winnings. You can claim losses up to the amount of gambling winnings you report. Keep in mind, though, the trade-off is not perfect because gambling winnings increase your adjusted gross income (AGI), and a higher AGI may reduce your ability to claim various tax deductions and credits.

Yes, Bovada Sportsbook can legally accept customers from Florida. Since Bovada is operating legally within the international sports betting industry, they may accept bettors from around the world, including the US and Florida. Residents of the Sunshine State can place bets at Bovada without violating any state or federal gambling laws. The short answer is, yes – there is legal sportsbook gambling available to Florida residents. There are no Florida state laws and no US federal laws that make it a crime to bet on sports in the USA as long as the destination at which you placing your wagers is legally licensed and regulated. Sports Betting in Florida Betting on sports in Florida is still a work in progress since the U.S. Supreme Court struck down the federal law that banned sports betting in 2018 and opened the doors for individual states to legalize sports betting. Betting on sports is not legal in Florida. Or, more specifically, accepting sports bets is not legal in Florida. That said, the state does not have any sports betting laws, on land or online, worth speaking of, and the legal status of betting is viewed by the public as being lumped in. Is sports gambling legal in florida. Sports betting legality in Florida is a tricky thing on the surface. There are no laws explicitly banning the activity, but there are also no regulatory laws allowing it, either. That said, laws in the US are based on what is prohibited, not on what is allowed.

Where To List Gambling Winnings On 1040 2019

Example 2: Joan Miller reports $10,000 of poker winnings on line 21 of her 1040. On Schedule A, Joan claims $6,000 of losses from poker, other table games, and horse racing bets. In effect, Joan winds up paying tax on $4,000 of gambling winnings.